A business check is written to issue funds from a business checking account, unlike a personal checking account. So, who’s logo should show on the top of the check?

Obviously, your company’s should be there, communicating that you are a legitimate business. When you hand someone a check, be it a supplier, contractor, or an employee, they should be rest assured that they are working with a trustworthy company. Beyond just a logo, checks can be customized with different background types and colors, as well as different fonts to more suit your identity.

Now that you’ve held up your end of the bargain, you might wonder how you are supposed to be shielded from fraud.

Anti-copy technologies such as color shifting inks and image shifting repeated text & graphics make the checks difficult to reproduce on a scanner or copier. This means that if someone attempts to reproduce or copy the check themselves, the word “VOID” will appear.

Thermochromic inks also prevent copies of a check from being made. These inks change color or disappear when heat is applied. This way, a bank or recipient can see that a check is genuine. Photocopiers will not be able to print to replicate this, also rendering them void.

Additionally, checks can include a holographic icon, which acts as another deterrent when using a copier or scanner.

As a business owner, you should also have the convenience of issuing your checks via accounting software, such as QuickBooks, Quicken, and Peachtree. Business checks offer this convenience with different formatting options, such as 3-to-a-page, or placing the check on the top, middle, or bottom of the page. You shouldn’t have to hand-write every single check!

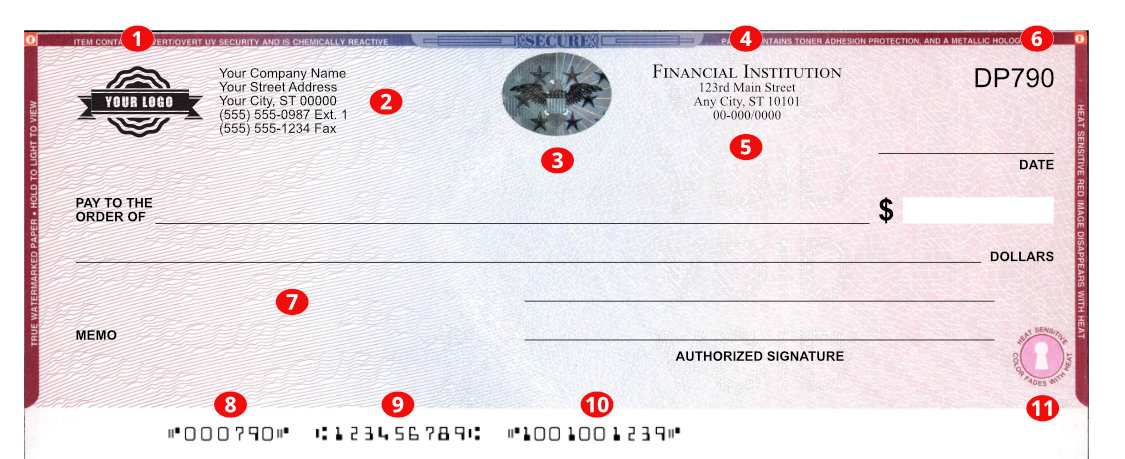

Ready to get started? At Dreamscape Printing, we offer customized business checks with all of these options and features! See our Ultimate Security series, as an example:

- Customized Logo (1 Color)

- Company Information (Name & Address)

- Hologram

- Bank Name and Information

- Fractional Number

- Check Number with Optional Prefix

- Color Shfiting Inks & Image Shifting Pantograph

- Consecutive MICR Number

- Routing and Transit Number

- Account Number

- Keyhole Thermochromic Icon

In addition to all of these items, our checks also display a ribbon on the top and sides, explaining the features that a financial institution should be looking for before cashing your checks.

Browse our business check options today!

Sign In

Review

Portfolio

Templates

Websites